Monday Trade Setup: 68 equities, including Apollo Tyres, JK Cement, ABB India, Dr. Lal PathLabs, and Hindustan Copper, showed a protracted build-up.

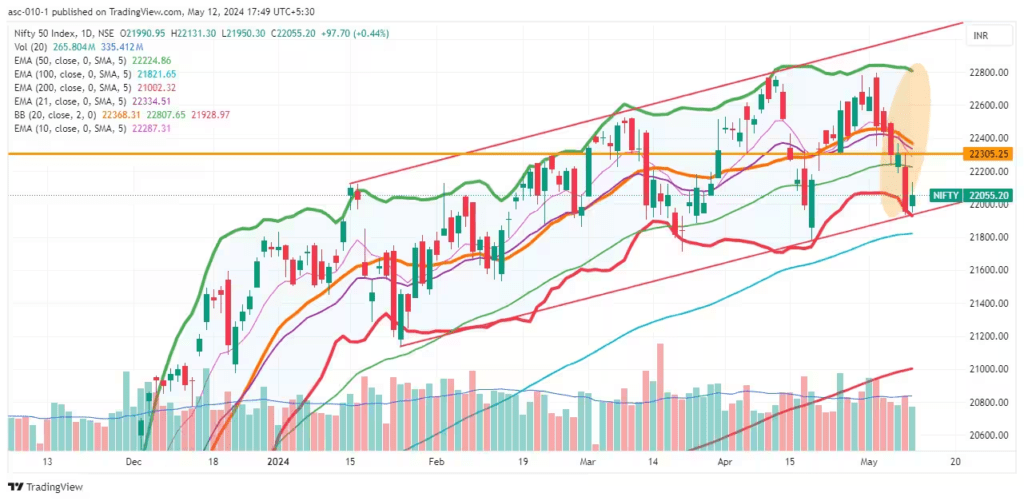

The market has not yet recovered, despite a surge on May 10 following a prolonged decline following its record high last week. The consolidation is anticipated to continue as long as the Nifty holds 21,900, the low of the long bearish candle of May 9 and which also corresponds with the rising support trendline. The index may encounter resistance at 22,200–22,300 levels, but a break of 21,900 could push it towards 21,775, the low of April, according to experts.

On May 10, the Nifty 50 gained 98 points to 22,055 and produced a tiny bullish candlestick pattern with a small upper and lower shadow on the daily charts, while the BSE Sensex increased 260 points to 72,665.

Technically speaking, this pattern suggests a little lull in the market following a steep collapse. The Nifty is currently trading near the critical trendline support of 21,900, and senior technical analysis analyst at HDFC Securities Nagaraj Shetti stated that there is still no sign of a higher bottom reversal pattern forming at the lows.

On the weekly chart, the Nifty displayed a lengthy bearish candle with a slight lower shadow. Nifty formed a lengthy bear candle last week, indicating negative bias, following the creation of a long-legged doji at fresh highs the week before.

Shetti feels having placed at the key trendline support, there is a possibility of minor upside bounce in the short term, but the market could eventually break down the present support of 21,900-21,850 levels and could slide down to 22,700-22,600 in the near term. “Immediate resistance is at 22,300 levels.”

Jigar S Patel, senior manager – equity research at Anand Rathi, also feels the index is nearing the lower boundary of an upward channel, and breaching the same could signal deeper market concerns. “Looking ahead, a drop below 21,900, the previous swing low of 21,777, may induce market panic,” he said.

Shetti believes that, given the market’s placement at the crucial trendline support, there may be a brief increase in the market’s value in the short run. However, if the market breaks below its current support level of 21,900–21,850, it may eventually descend to 22,700–22,600. “Immediate resistance is at 22,300 levels.”

According to Anand Rathi’s senior manager of equity research Jigar S. Patel, the index is getting close to the lower bound of an ascending channel, and breaking it might indicate more serious market concerns. “Looking ahead, a drop below 21,900, the previous swing low of 21,777, may induce market panic,” he stated.

Meanwhile, the elevated volatility also seems to be keeping the bears in action against bulls. India VIX, the fear gauge, rallied 81 percent in the past 12 consecutive sessions, to 18.47 levels, the highest closing level since October 13, 2022.

Here are 15 data points we have collated to help you spot profitable trades

Key support and resistance levels on the Nifty and the Bank Nifty

According to the pivot point calculation, the Nifty 50 might find immediate support at 21,976 points, then 21,934 and 21,865 points. On the upward side, resistance is anticipated for the index at 22,072, 22,157, and 22,227 points.

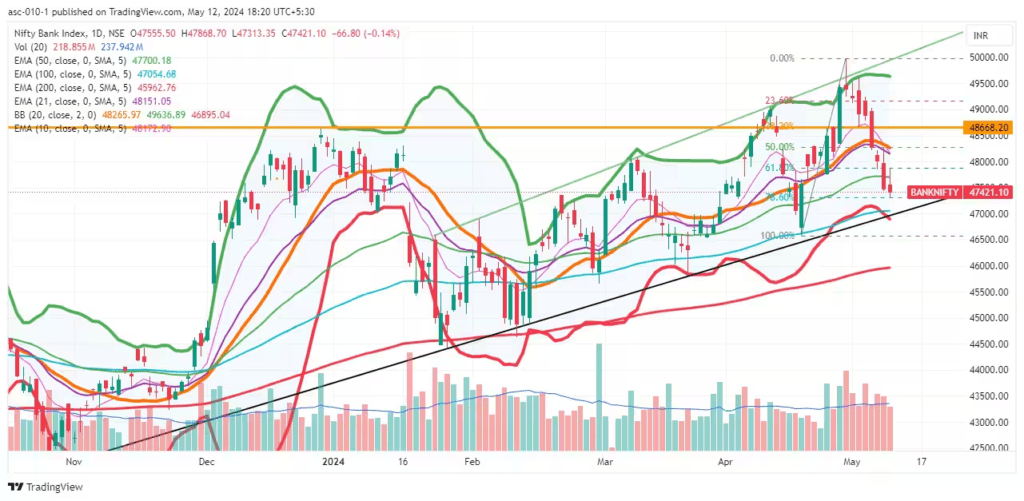

The banking index continued to decline for the eighth straight session despite an attempt to regain ground. Ultimately, it finished 67 points lower at 47,421. On the daily charts, the index created a little negative candle with a lengthy upper shadow, suggesting selling pressure at higher levels. However, experts indicated that since the index is close to the middle of the Bollinger band, a pullback rally cannot be completely ruled out in the coming days.

“The Bank Nifty is approaching the 20-week moving average placed at 47,240 and thus a sharp decline from current levels appears unlikely,” Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

Hence, he expects a relief rally during the next week.

According to the pivot point calculator, the Bank Nifty index is likely to take support at 47,322, followed by 47,191 and 46,979. On the higher side, the index may see resistance at 47,472, followed by 47,878 and 48,090.

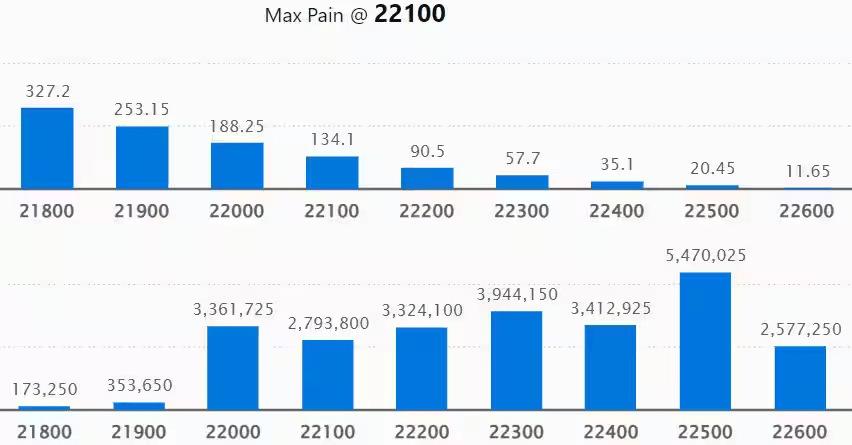

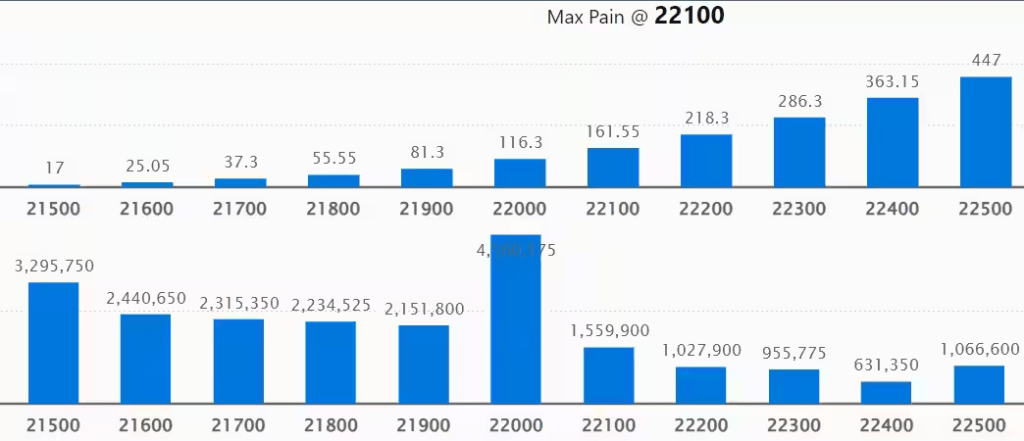

Call options data

The weekly options data showed that, with 68.44 lakh contracts, the 23,000 strike had the most Call open interest. In the near run, this level may serve as the Nifty’s primary resistance. The 22,500 strike, with 54.7 lakh contracts, came next, and the 22,800 strike, with 48.22 lakh contracts, came after it.

At the 22,800 strike, which resulted in the addition of 15.6 lakh contracts, meaningful call writing was observed. 22,500 and 22,900 strikes that added 14.49 lakh and 10.25 lakh contracts came after it.

The 23,000 strike showed the most Call unwinding, with 4.84 lakh contracts destroyed. Then came the 21,900 and 22,300 strikes, with 43,250 and 29,200 contracts shed, respectively.

Put option data

On the Put side, the maximum open interest was seen at 21,000 strike, which can act as a key support level for the Nifty with 58.24 lakh contracts. It was followed by the 22,000 strike, comprising 45.6 lakh contracts and then the 21,500 strike, with 32.95 lakh contracts.

The maximum Put writing was visible at the 21,000 strike, which saw an addition of 27.77 lakh contracts, followed by 22,000 and 21,600 strikes, with 15.28 lakh and 9.71 lakh contracts additions, respectively.

Put unwinding was observed at the 22,200 strike, which shed 1.6 lakh contracts. This was followed by 22,600 and 20,700 strikes, with a reduction of 60,400 and 43,925 contracts, respectively.

tocks with high delivery percentage

A high delivery percentage reflects investor interest in a stock. Kotak Mahindra Bank, United Spirits, Shriram Finance, Voltas, and Infosys saw the highest delivery among the F&O stocks.

68 stocks see long build-up

A long build-up was seen in 68 stocks, including JK Cement, ABB India, Dr Lal PathLabs, Hindustan Copper, and Apollo Tyres. An increase in open interest (OI) and price indicates a build-up of long positions.

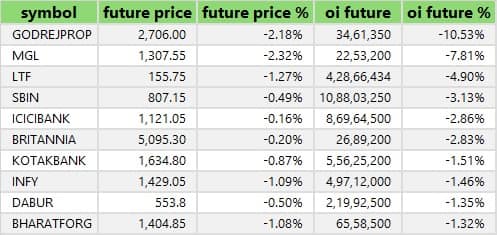

15 stocks see long unwinding

Based on the OI percentage, 15 stocks saw long unwinding, which included Godrej Properties, Mahanagar Gas, L&T Finance, State Bank of India, and ICICI Bank. A decline in OI and price indicates long unwinding.

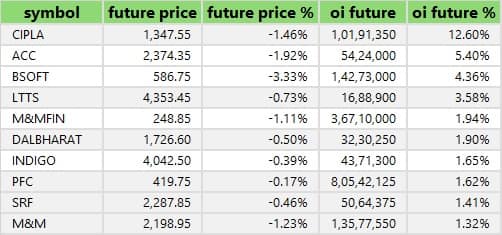

23 stocks see a short build-up

A short build-up was seen in 23 stocks, including Cipla, ACC, Birlasoft, L&T Technology Services, and M&M Financial Services. An increase in OI, along with a fall in price, points to a build-up of short positions.Gift Nifty Live todayA short build-up was seen in 23 stocks, including Cipla, ACC, Birlasoft, L&T Technology Services, and M&M Financial Services. An increase in OI, along with a fall in price, points to a build-up of short positions.

81 stocks see short-covering

Based on the OI percentage, 81 stocks saw short-covering, which included Coforge, BPCL, Lupin, Can Fin Homes, and Pidilite Industries. A decrease in OI, along with a price increase, is an indication of short-covering.

Put-Call Ratio

The Nifty Put-Call ratio (PCR), which indicates the mood of the market, rose to 0.91 on May 10, from 0.90 levels in the previous session.

The increasing PCR or higher than 0.7 or surpassing 1 means traders are selling more Put options than Calls options, which generally indicates the firming up of a bullish sentiment in the market. If the ratio falls below 0.7 or moves towards 0.5, then it indicates selling in Calls is higher than selling in Puts, reflecting a bearish mood in the market.

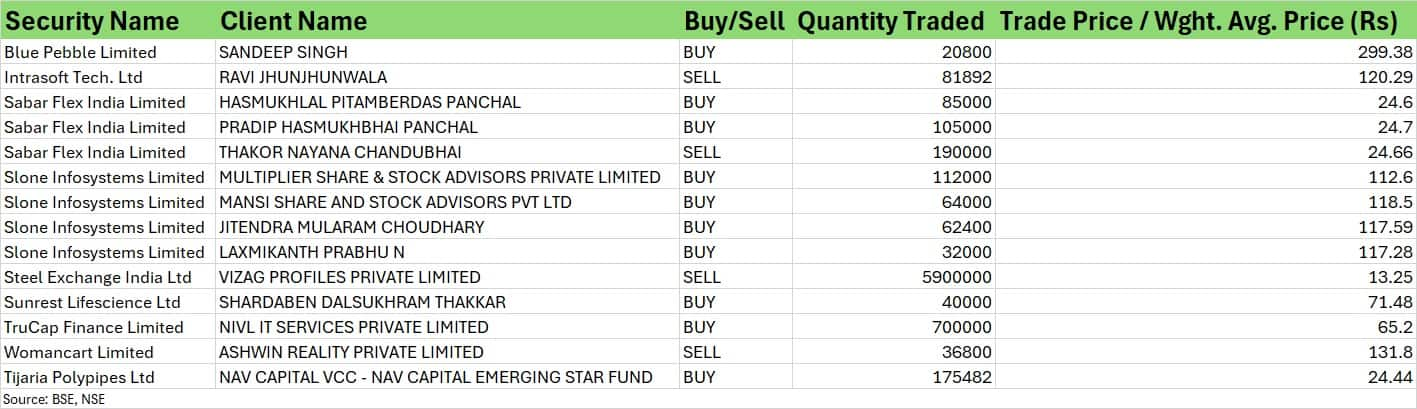

Bulk Deal

UPL, DLF, Zomato, Jindal Steel & Power, Varun Beverages, Aditya Birla Capital, BLS E-Services, Chalet Hotels, GIC Housing Finance, Ind-Swift Laboratories, INOX India, C E Info Systems, and Tube Investments of India will release March quarter earnings on May 13.

Stocks in News

Tata Motors: The passenger and commercial vehicles maker has recorded consolidated net profit at Rs 17,407 crore for quarter ended March FY24, growing 222 percent over corresponding period of previous fiscal driven tax credit of Rs 8,159 crore and strong operating numbers. Revenue from operations grew by 13.3 percent year-on-year to Rs 1,19,986 crore for the quarter.

Eicher Motors: The automobile company has reported standalone net profit at Rs 983.3 crore for March FY24 quarter, growing 32 percent over the same period of previous fiscal, backed by strong operating numbers. Revenue from operations grew by 9.4 percent YoY to Rs 4,192 crore for the quarter.

Union Bank of India: The public sector lender has registered a 19 percent on-year growth in net profit at Rs 3,311 crore for the fourth quarter of fiscal year 2024, with 20 percent on-year decline provisions. Net interest income grew by 14.4 percent year-on-year to Rs 9,437 crore for the quarter.

ICICI Bank: Bijith Bhaskar has resigned as Head – Cards, Payment Solutions, E-Commerce Ecosystem, Merchant Ecosystem, Consumer Finance of the bank. He was a part of the Senior Management Personnel Group.

Zydus Lifesciences: The pharma company has received final approval from the United States Food and Drug Administration (USFDA) to market Dexamethasone tablets in the US. Dexamethasone is used to treat conditions such as arthritis, blood/hormone disorders, allergic reactions, skin diseases, eye problems, breathing problems, bowel disorders, cancer and immune system disorders.

Funds Flow (Rs crore)

FII and DII data

Foreign institutional investors (FIIs) net sold Rs 2,117.50 crore shares, while domestic institutional investors (DIIs) pumped in Rs 2,709.81 crore worth shares on May 10, provisional data from the NSE showed.

Stocks under F&O ban on NSE

The NSE has added Hindustan Copper to the F&O ban list for May 13, while retaining Balrampur Chini Mills, Canara Bank, GMR Airports Infrastructure, Vodafone Idea, Punjab National Bank, SAIL, and Zee Entertainment Enterprises to the said list. Aditya Birla Fashion & Retail, and Piramal Enterprises were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Stay Connected With us: Siasatpro.com

Recent Comments